NayaPay Digital Wallet in Pakistan

Nayapay, launched in Pakistan in 2020, aims to facilitate money transfers from one person to another.Its purpose is to transfer your digital money from one person to another easily and very securely.This is the most amazing digital wallet of Pakistan

- NayPay was founded in 2020

- Secured a $13 million investment from international investors like Checkout.com, MSA Capital, and MDI Ventures in 2021

- In 2022, it launched its debit card service, enabling users to make online and in-store payments.

- In 2023, it formed a key partnership with Telenor Microfinance Bank, expanding its reach to millions of potential users.

Create NayaPay Account and Download App

To create a Naya Pay account, you will need its app. You will find the app on the Play Store. Search the Naya page. You will find Naya Pay at the top of the Play Store, and I will also give you the link. You can also download it by clicking on the download button below.

Create NayaPay Account

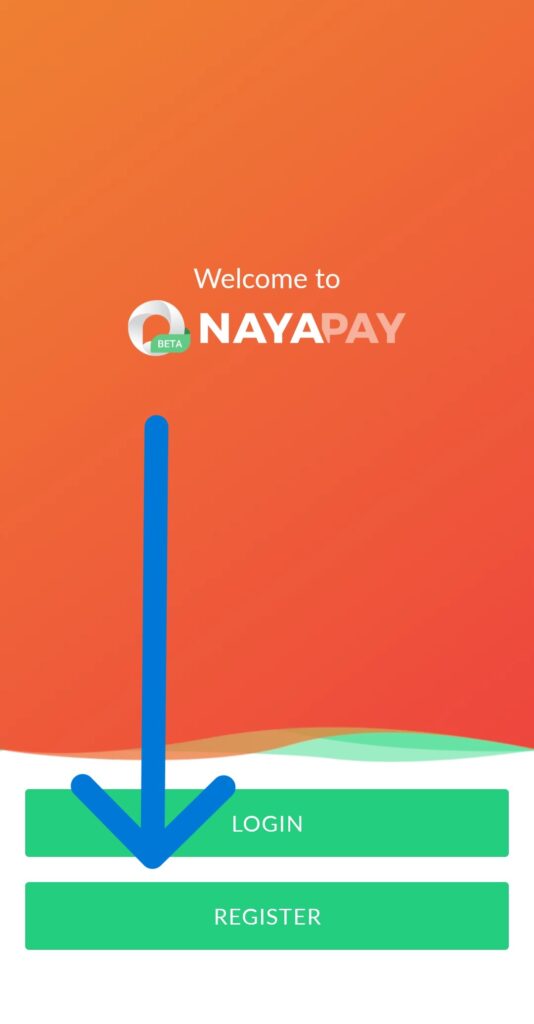

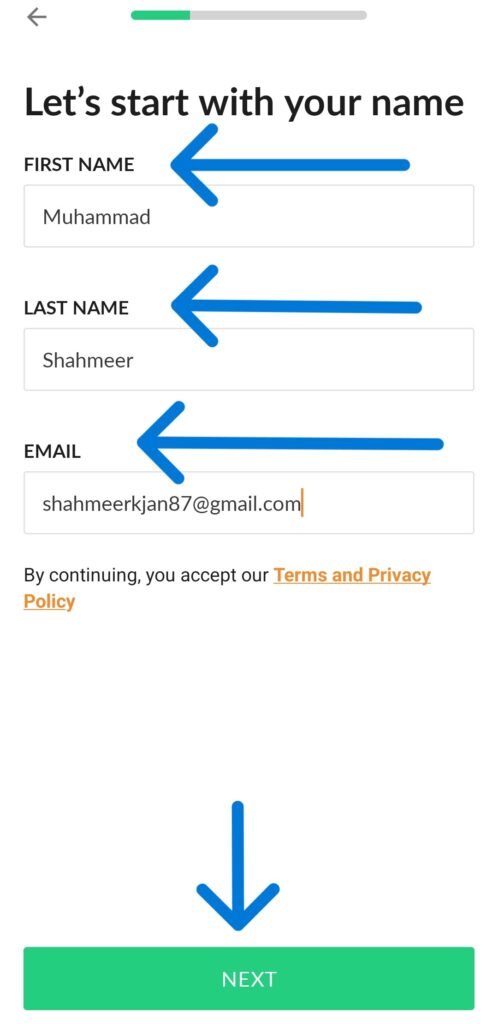

Open NayaPay; there you will see an option to login and another option to register. You have to click on the option of registration; it will ask you for your first and last name, and after that, you will be asked. It will ask for your Gmail account.

After that, it will ask you for your phone number, you have to give your phone number, an OTP will be sent to your phone number, you have to write it here, after that it will be registered.

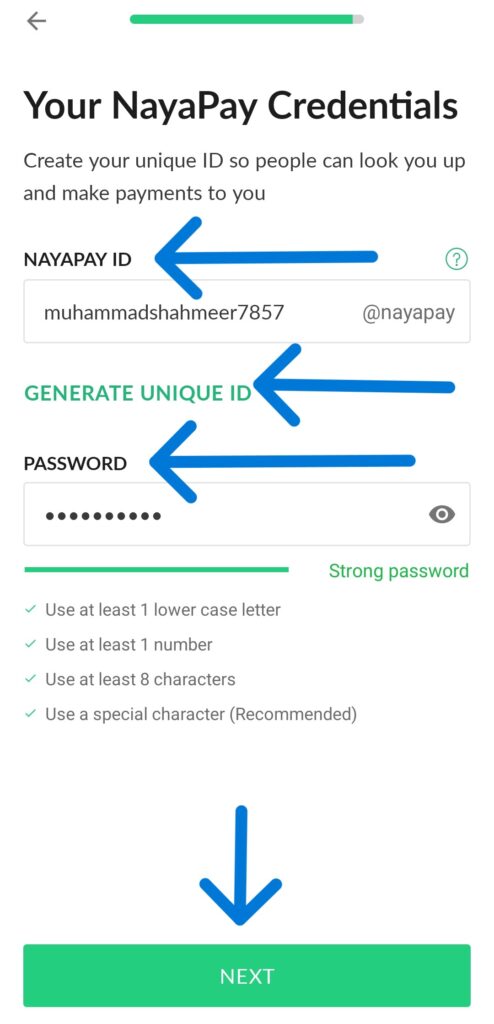

After entering the OTP, it will ask you to create your new Pay ID and below it will ask you to put a unique password. You have to set a unique strong password

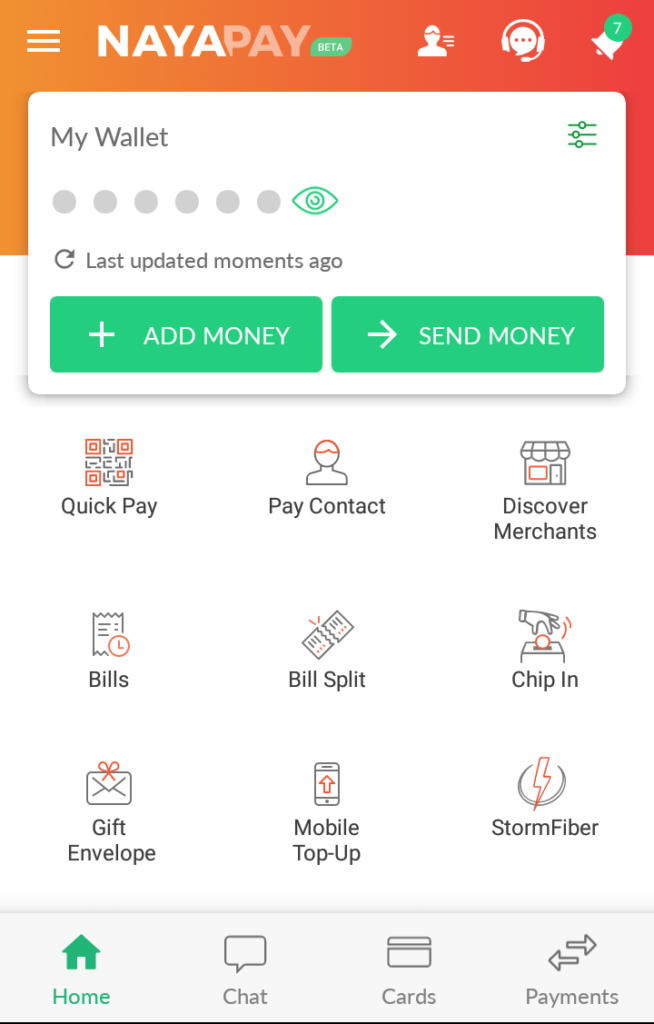

After registering, your account goes for review, it takes 2 days and the NayaPay team reviews and approves it. After the account is approved, you have to deposit Rs 300 in it so that you can order the debit card for free.

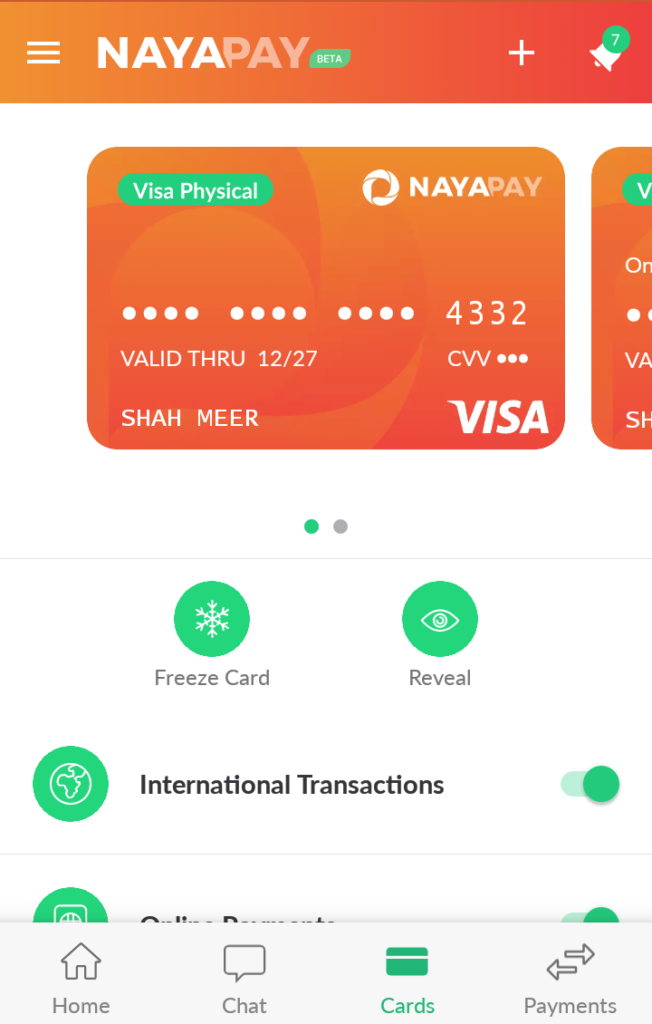

Cards

On the card option, you see your credit card or debit card. In this, you get a virtual credit card, and the other one is a physical debit card. You can make payments from the ATM. to draw on

Here, your card is shown. You can also block your card for international transactions and turn it on. By clicking on Reveal, your card will be shown. By clicking on Freeze Card, your card will freeze. After that, you can also set someone’s transaction limit.

Features and Benefits:

Functionalities offered by NayaPay

- Sending and receiving money (including free transfers between NayaPay users and transfers to bank accounts)

- Making online and in-store payments using the NayaPay debit card

- Paying bills (mobile, utilities, etc.)

- Shopping through microapps on the platform

Benefits offered by NayaPay

- Convenience and ease of use

- Security and reliability

- Time-saving compared to traditional payment methods

- Access to discounts and deals

Recent Developments

- January 2024: Collaborate with Alipay+, a global digital payments platform, to boost cross-border payments and improve international remittances to Pakistan. This partnership allows users to seamlessly send and receive money between Alipay+ and NayaPay accounts using QR codes.

- November 2023: Received the “Best Fintech” award at the Pakistan Banking Awards, cementing its position as a leading innovator in the country’s financial technology sector.

- March 2023: Collaboration with Bank of Punjab (BoP) to facilitate cash deposits into Nayapay accounts at any BoP branch. This partnership enhances user convenience and accessibility.

- January and October 2022: Partnership with Habib Bank Limited (HBL) and United Bank Limited (UBL) to facilitate faster international remittances to Pakistan. These collaborations aim to improve the efficiency and accessibility of remittances from abroad to the country.

These recent developments showcase NayaPay’s commitment to:

- Expanding its international reach through partnerships with global players such as Alipay+.

- To improve user experience by providing convenient services like cash deposits in partner banks.

- Increasing financial inclusion by facilitating fast and easy international remittances.

Comparison With EasyPaisa & JazzCash

Here’s a brief comparison of NayaPay with two other leading digital wallets in Pakistan, EasyPaisa and JazzCash:

| Feature | NayaPay | EasyPaisa | JazzCash |

|---|---|---|---|

| Year Founded | 2020 | 2009 | 2011 |

| Parent Company | None (independent EMI) | Telenor Microfinance Bank | Mobilink (part of the Millicom Group) |

| Key Features | Money transfer (free within NayaPay) | Money transfer (free within EasyPaisa) | Money transfer (free within JazzCash) |

| Bill payments | Bill payments | Bill payments | |

| Online & in-store payments (debit card) | Online & in-store payments (app) | Online & in-store payments (app) | |

| Micro-AApps for Shopping | Mobile top-up & data bundles | Mobile top-up & data bundles | |

| Investments & insurance | Investments & insurance | ||

| Fees | Varies depending on transaction type | Varies depending on transaction type | Varies depending on transaction type |

| Network Coverage | Independent network | Extensive network through Telenor | Extensive network through Mobilink |

| **International Remittances | Partnering with Alipay+ | Partnering with Western Union | Partnering with MoneyGram, Western Union & others |

| Recent Developments | Partnership with Alipay+ | Integration with Telenor Microfinance Bank | Partnerships with HBL & UBL for remittances |

Conclusion

NayaPay is not another app; it is the gateway to a more convenient and secure financial future. It’s your friendly neighborhood digital wallet, always there to help you (or, rather, a digital wallet) when you need it most. So, ditch the heavy wallet and embrace the simplicity and security offered by NayaPay. Remember, going digital is the new thing, and with NayaPay, you can be part of the revolution one tap at a time. But hey, if the whole digital thing isn’t your thing, at least you’ll have a good story to tell about the time you impressed your friends by paying for movie tickets.